Median = Misleading

Chevron is moving its entire headquarters complex from California to the much more business-friendly Houston, TX area.

I happen to know a lot of Chevron employees – and what is interesting is that most of the younger and newer employees are moving to Houston too, as they don’t really have a choice.

But, many of the older and wealthier employees are staying because they can and want to, and/or because they want to see if the high-end housing market heats up again.

Similarly, I have another acquaintance in his 50s who was effectively laid off from a tech company (took an early retirement package), and he didn’t care because he had so much cash saved.

He and his wife plan to stay where they are in a $2.5 million home – while he figures out what he wants to do. In contrast, I know of younger employees for that same company who are scrambling to find new jobs and willing to move anywhere – if necessary.

The above stories are anecdotal, but they are illustrative of one of the reasons why the “median house price” is dropping. Lower-end sellers often have to sell, while higher-end sellers often do not.

As a result, the overall housing market is skewed by the higher percentage of lower-end homes hitting the market. And that in turn skews the “median home price” lower.

Remember: “Median” just means “midpoint” – where half of all homes sell for more, and half of all homes sell for less. It is not an average – so the median can easily be skewed when more lower-end homes are selling.

This is a huge problem because market analysts and appraisers alike rely on median home price data to assess whether a market is declining or not.

But – what we really might be seeing is just a much higher percentage of smaller homes hitting the market. (If any readers have data backing this up, I would love to see it)

Appraisers Checking the Declining Market Box

I shared the above information not just because I think the “median” data is so misleading – but also because appraisers are relying on it right now and sometimes marking the dreaded “declining market” box on appraisals.

And – as per usual – I am going to defend appraisers. They do not mark that box because they are ignorant or evil. They usually mark that box because they have to (just doing their jobs) – if they want to avoid getting kicked off appraisal panels, losing their license, or getting sued.

Appraisers are required to pull median house price data over the last 12 months and report what they see in their “Market Conditions” addendum.

If they ignore the data or contradict it – appraisal reviewers will spot the error and that in turn subjects appraisers to the risks I mention above.

What Does It Mean?

Fannie Mae and Freddie Mac require the data to prevent appraisers from “overvaluing” a property and to alert buyers.

But – it does not impact financing terms.

Some jumbo lenders, however, increase their minimum required down payment by 5% when they see the declining market box checked – and that is a problem.

Why It Can Be Frustrating

- MISLEADING: The declining market moniker is sometimes misleading when it relies entirely on “median home price” data, as per what I explain above.

- KILLS JUMBO DEALS: It can sometimes effectively kill a jumbo deal, if the jumbo investor is one that cuts loan-to-value ratios.

- SCARES BUYERS: It can unnecessarily scare buyers.

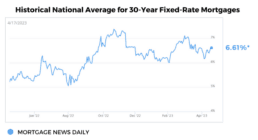

- DATA LAGS: It relies on lagging data, and the moniker remains in place even if the current market appears stable or even heating up – like we are seeing in many areas now. And like what we will see even more if and when rates fall further.

What Is JVM Doing about It?

We are very aggressively looking for data that indicates the current market is stable or heating up, and also looking for data that proves that the median home price has been skewed downward by the increasing number of lower-end sales.

We are also encouraging appraisers to rely on some other data sources such as Case Schiller instead of MLS – when such sources seem more accurate.

We will then use this data to hopefully rebut the declining market indicator. If the market is actually “declining,” we are not averse to the moniker – of course.

We just don’t want to unnecessarily alarm buyers or see jumbo deals get killed – if the data is inaccurate.

Jay Voorhees

Founder | JVM Lending

(855) 855-4491 | DRE# 1197176, NMLS# 310167