Buyers Immediately Leave Market When Rates Move Higher

One of the most surprising aspects of the rate increases we have been watching over the past year is how quickly buyers and borrowers respond to the increases.

We all of course expect to see less refinance and purchase activity in response to higher rates.

But, what I never expected and still cannot begin to understand is how activity plummets almost immediately after rates edge higher.

Hence, if rates increase even 1/8%, we will often see fewer contracts come in the next day or even the same day (as if buyers are hovering over Bloomberg terminals watching interest rates).

At first, I thought this was just a coincidence, but I have seen this take place so many times that I now think there is a direct correlation.

This is why it is such a big deal when rates shoot up over a short period of time – like we have seen over the past 12 days.

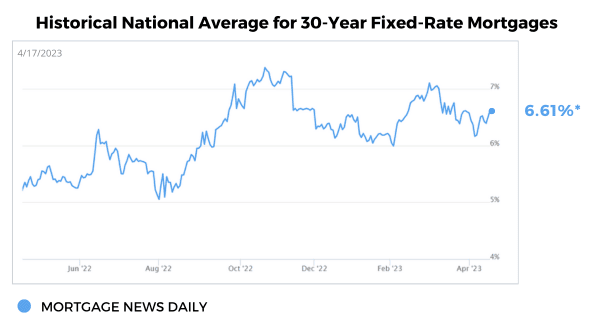

According to the Mortgage News Daily chart at the bottom of this blog, the average 30-year conforming rate bottomed out at 6.16% on April 5th.

The average conforming rate today is 6.61% – and climbing as I type.

So – rates have increased almost 1/2% – and activity has slowed markedly in response.

Why Did Rates Shoot Up?

Rates shot up in response to some stronger-than-expected retail sales and industrial production numbers. They also shot up in response to some comments by a Fed Governor – who thinks today’s very strong labor markets portend more inflation.

And then today we got some additional strong manufacturing data as well as stronger-than-expected consumer sentiment reports.

Also – disconcerting were higher hotel and airline costs – both of which portend more inflation.

All of this data makes it more likely that the Fed will increase rates again in May – and that now seems likely.

When Will Rates Fall?

Jeff Snider reminds us repeatedly in his podcasts that “the markets have priced numerous rate reductions this year,” despite what the Fed says.

He and other analysts also tell us that bank lending is plummeting, and that yield curves remain steeply inverted (when short-term rates are higher than long-term rates).

And – both of these factors indicate that a recession is on the horizon. Other indicators include falling shipping rates and purchase orders.

Barry Habib further reminds us that unemployment always bottoms out just prior to recessions. So, once again, the Fed’s focus on today’s tight labor markets makes no sense.

Habib finally reminds us that May 10th is the big day when he expects a very positive inflation report.

So – rates will fall in May, if not sooner, as more and more recession indicators start to surface.

And then they will likely fall again and again for the rest of the year.

So, it sounds like declining inflation and possibly weak economic signals will bring rates down in the near term, while major economic issues will bring rates down later on this year (if Snider and Habib are right, and they have been more right than anyone else over the last several years).

BUT – rates will never move in a straight line up or down.

And – that is why we have been seeing rates bounce up and down over the last several months – and it is likely that we will continue to do so.

Most importantly though, the rate increases we have seen recently are very likely not here to stay.

Jay Voorhees

Founder | JVM Lending

(855) 855-4491 | DRE# 1197176, NMLS# 310167