Median Pizza Price PLUMMETED at JVM!

We are in a literal state of panic here at JVM because the median price of pizza has dropped like a rock over the last year – and we are pretty sure it is a sign of a total meltdown in the pizza market!

In 2021, we only ordered large pizzas, but in early 2022, we started to order large AND MEDIUM pizzas so we could have a wider variety of toppings.

And sure enough, we noticed that our “median pizza price” has absolutely collapsed (by almost 20%!!).

What made this even more shocking was the fact that our local pizza vendor had actually raised the price of BOTH medium and large pizzas by $2 – indicating that pizzas had APPRECIATED by 6%.

Sidebar: The millennials in our office order pizzas with balsamic vinegar, chicken and/or no cheese, and it is pretty disgusting (but that is a topic for another blog, as we boomers clearly have better taste in pizzas).

Balsamic vinegar aside, the above story illustrates the folly of focusing on “median prices.”

The median pizza price fell at JVM solely and only because we started to order SMALLER PIZZAS; it was most definitely not because the pizza market is collapsing.

And all this is analogous to the media’s obsession with the “median home price” – which is often ridiculously misleading.

Why The “Median Home Price” Is Misleading

Earlier this week, the “Existing Home Sales” report was released for February, and it showed that the median home price in the U.S. had dropped by a whopping 0.2% from February of 2022.

The media pounced on this with headlines that screamed: “Home Prices Go Negative!”

But… alas, they didn’t.

As we all know, the median home price simply measures the “middle” price of all homes that sold – meaning that half of the homes sold for a higher price and half sold for a lower price.

So, if smaller and cheaper homes start to comprise a larger % of all homes sold, the median price will drop – even if home prices appreciate overall.

AND – that is exactly what happened over the last year. The percentage of lower-priced homes sold increased, while the percentage of higher-priced homes decreased.

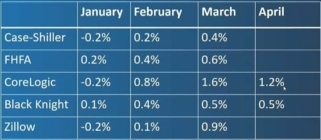

So, the median home price did drop by 0.2% – which is pretty much zero in any case – while housing overall APPRECIATED BY 5.8% over the same period, according to Case-Shiller.

Our favorite analyst, Barry Habib, illustrated this on Tuesday with a table that showed how the % of homes sold in the $100-$250k range increased by 2.0% over the last year, while the % of homes in the $250-$500k range decreased by 1.5% – and that is what fostered most of the drop in the median price.

TLDR: (1) The median home price indicator is very misleading because it is easily skewed by the overall price mix of homes sold – whether the actual market is appreciating or depreciating; (2) The media are almost always wrong when it comes to their click-baiting and scare-mongering; and (3) Homes APPRECIATED 5.8% over the last year.

Sign up to receive our blog daily