How The Media Skews “Median Home Price” Data

“Low inventory and high demand from homebuyers pushed up U.S. home prices in February.”

“The index posting a gain after seven months of decline is ‘suggesting that home prices nationally have bottomed out,’ Selma Hepp, chief economist at CoreLogic, said in a note.”

Both of the above quotes are from this MarketWatch article from yesterday, discussing the latest S&P Case-Shiller CoreLogic Home Price data.

This data reflects average prices, and the report is about 10,000x more accurate as a home appreciation indicator than the “median price” reports that I often skewer in my blogs, e.g. Putting the “Median Home Price” Nonsense to Bed Once and For All.

Media outlets are of course trying to spin the latest data in the worst possible light, but the news is almost all good.

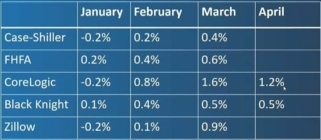

Month-over-month (Feb compared to Jan), home prices were up nationwide by 2.9%.

Year-over-year (Feb of 2023 to Feb of 2022), home prices were up by 2%.

BUT – home prices are still down 2.9% from their peak – so that is really bad, right?

Not even close. A decline of 2.9% is still “good news” because that number represents the total of the so-called “housing crash” – particularly when we remember that home prices rose about 140% overall over the last 10 years.

Need more good news? Even beleaguered San Francisco saw a month-over-month gain of 1%.

FHFA Released Its Home Price Index

FHFA (the entity that regulates Fannie and Freddie) also recently released its home price index, and its numbers were even stronger.

Per FHFA, February saw a month-over-month gain of 0.5% – which works out to a 6% annual gain.

And year-over-year, February saw 4% appreciation.

Most importantly, FHFA’s numbers are down only 0.2% from the peak – meaning the market pretty much held steady overall, as 2/10 of 1% is statistically insignificant.

FHFA’s numbers are stronger than Case-Shiller’s because they only look at financed purchases at the conforming loan level, while Case-Shiller’s numbers include ALL transactions – including jumbo and cash purchases (which tend to skew prices lower).

In summary, very tight inventory and strong demand are propping up housing prices. And when rates fall later this year (and they will), prices will only climb that much more.

Barry Habib literally guaranteed that home prices will rise in 2023 yesterday in his morning update – and I am still waiting for him to be wrong.

Sign up to receive our blog daily