Many homebuyers are surprised by how easy it is to get a mortgage. Most people worry that the mortgage process will be too difficult or that their credit scores will be too low to qualify for competitive financing. The mortgage process is often easier for homebuyers in California and Texas than they expect.

HOW DOES THE MORTGAGE PROCESS WORK?

The mortgage process for homebuyers begins by filling out a loan application with a reputable mortgage bank to get a fully underwritten pre-approval letter. Homebuyers use their pre-approval letter to make their offers on houses stronger. Once homebuyers have their offer accepted, they will work with their lender to get their loan approved.

See JVM Lending’s Daily Rates

Homebuyers can expect to fill out disclosures, lock in their interest rate, and work with their Mortgage Analyst to get their file prepared for escrow and underwriting to review. Once a homebuyer’s loan is approved, the mortgage bank is clear to give the homebuyer the funds needed for their mortgage. Mortgage banks use funds from a specialized line of credit called a “warehouse line.”

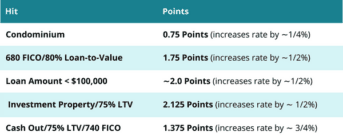

After the close of escrow, the mortgage bank will sell the homebuyer’s loan to an investor on the Secondary Market. Investors (like other banks) or government entities (like Fannie Mae and Freddie Mac) purchase the loan for their portfolios. Mortgage banks use parts of those proceeds to pay off the warehouse line to free up funds for another loan. The rest goes of the proceeds go toward paying employee salaries and overhead. The price the investor pays for a loan varies according to market conditions. Lenders know what they will be able to sell each loan for and set their daily rates accordingly.

DO HOMEBUYERS NEED A PERFECT CREDIT SCORE?

About three million Americans in 2017 had perfect FICO credit scores of 850. But, other than granting bragging rights, perfect scores don’t carry much weight when it comes to mortgage financing.

The highest score that homebuyers can benefit from when applying for a home loan is 740. For jumbo loans, the highest score a homebuyer can benefit from is 780. Underwriters don’t make it easier for homebuyers with perfect credit scores, and they don’t offer lower rates.

Consumer credit scores are very different from the scores that mortgage lenders pull. Mortgage lenders pull when they are qualifying the homebuyers. Mortgage lenders pull a homebuyer’s credit score from three major credit bureaus: Transunion, Equifax, and Experian. Lenders then correlate to the lower middle of the three scores.

There are a lot of factors that play a role in qualifying a homebuyer’s loan and whether that loan successfully closes. Lenders consider the “big picture” of the homebuyer’s application, and credit scores are just one part of a homebuyer’s profile. The best way to find out what buyers qualify for and what loan program is the best option for them is to talk to a local lender like JVM Lending.

Ready To Get Started?

JVM Lending makes mortgages easy for homebuyers! Our expert team of Mortgage Analysts is available 7-days a week; by phone at (855) 855-4491 or by email at jvmteam@jvmlending.com.