Agent Was Furious Because Her Client’s Interest Rate Was Too High!

We recently had an agent scream at us (yes, scream) because of the rate we quoted to her client.

Our rates of course are notoriously low and we also are not allowed to quote different rates to different clients.

So, sadly, the only thing that spawned the anger of that agent was her misunderstanding of how much credit scores affect interest rates.

As I remind readers often in this blog, there is “no one interest rate for every borrower” because there are so many factors that influence every borrower’s rate.

13 Factors That Impact Your Mortgage Rate

Because this message is important (to avoid the exact type of frustration exhibited by the agent above), we frequently reference and re-post this blog: 13 Factors That Impact Your Mortgage Rate.

One of the biggest factors of course is your CREDIT SCORE!

And the borrower I mentioned above had a lower credit score – and that is the sole reason his rate was relatively high.

Examples Of How Credit Impacts Interest Rates

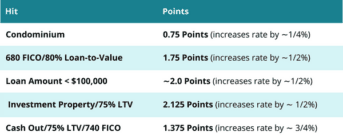

In light of this, one of our team members prepared the below table to illustrate just how much credit scores can impact interest rates.

| Credit Score: | 680 | 740 | 800 |

|---|---|---|---|

| $500,000 | 6.625% | 6.625% | 6.625% |

| $1,000,000 | 7.000% | 6.125% | 5.875% |

*$500k loan amount, 680 credit score assumes $7,300 in points; $500k loan amount, 740 credit score assumes $2,000 in points; $500k loan amount, 800 credit score assumes $2,000 in points

**$1 million loan amount, 680 credit score assumes the cost of 1 point; $1 million loan amount, 740 credit score assumes no points; $1 million loan amount, 800 credit score assumes no points

She used a $500,000 conforming loan and $1 million jumbo loan for her illustration, and she assumed the loans were 80% loan-to-value (20% down) purchase money financing.

NOTE: The rates quoted below are based on the interest rate environment as of 10/4/2022 (and may not be accurate today or at the time this blog is read); they are provided only to illustrate the “spread” between rates for borrowers with different credit scores – when all other factors are equal.

Note that conforming loans only reward FICOs up to 740; there is no advantage for being significantly over 740 – like there is with jumbo financing.

Jay Voorhees

Founder/Broker | JVM Lending

(855) 855-4491 | DRE# 1197176, NMLS# 310167