We hosted a large Tech Expo recently and we had two presenters discuss the importance of “life events” again.

I have discussed this numerous times now but want to hit again simply because the topic is so important; because data is so much more accessible now; and because the data can help ALL of us close far more transactions.

LIFE EVENTS THAT PORTEND A MOVE IN THE NEXT 12 MONTHS

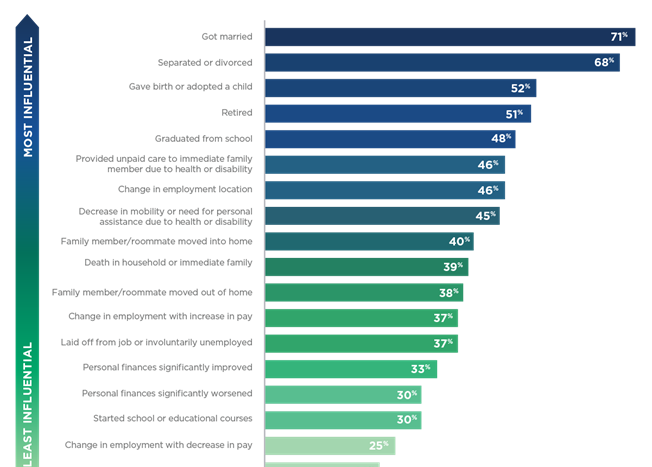

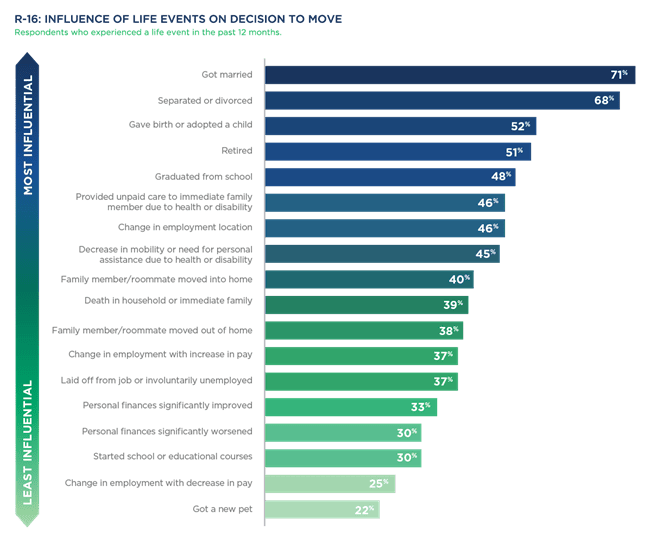

Below is a table from Zillow that sets out major life-events and the likelihood that they will result in a move.

Topping the list are:

- Marriage (71%)

- Divorce/separation (68%)

- Babies (52%)

- Retirement (51%)

Interestingly, the table omitted a major event that was illuminated by one of our Tech Expo speakers: Mortgage Defaults (52%).

Mortgage defaults are far less common nowadays, but as soon as the next recession hits (and it will), default numbers will surge.

The bigger point is that ALL of these events can be spotted with amazing accuracy with publicly available data sources.

The other point is that if agents just “farm” there is only a 3% chance that any given recipient of their marketing materials will move in the next 12 months (and that number is even lower in high-end, low-inventory markets like we see in the Bay Area often).

PENDING LIFE EVENTS THAT MAKE REFINANCING NECESSARY

Borrowers should refinance no matter what if the refinance will pay for itself in under four years (our rule of thumb).

But there are many life events that make refinancing sooner rather than later absolutely necessary. Here are a few:

- Moving to a new primary residence. Owner-occupied financing typically involves rates that are about 1/2 percent lower than investor-financing. If someone intends to move, they should consider refinancing for either “cash out” or a lower rate (if so desired) prior to giving up the preferential rate-treatment associated with primary residence financing.

- Going back to school. Most borrowers are unable to qualify for mortgages without their full-time employment income. Hence, if they are giving it up to return to school, they should consider a refi first.

- Retirement. While we can use retirement income (and assets in some cases) to help qualify borrowers, many borrowers give up too much income to qualify when they retire.

- Job Change – with commission, bonus income, or entering a new field. Job changes in and of themselves do not usually affect a borrower’s ability to qualify. But, if borrowers receive most of their income in commission or bonuses, they might be forced “to season” that commission or bonus income for two years before they can use it to help qualify. Similarly, if borrowers switch careers into an entirely new field, they might need “to season” their new job for six months.

BIG DATA SOURCES

Here are two sources for life event data that I reference often:

- Do It Yourself – Title Toolbox. This is an entirely free data source that gives agents and loan officers access to a treasure trove of data – including life events.

- Predictive Analytics – Revaluate. I tout these guys often because they are so inexpensive and effective. We “partner” with them too to offer discounts. But, for a very small monthly fee, they will do all of the heavy lifting for agents.

Like what you’ve read? Subscribe & stay informed!

Sign up to receive our blog daily

Jay Voorhees

Founder/Broker | JVM Lending

(855) 855-4491 | DRE# 01524255, NMLS# 335646