Russian Mobster Sending Me Lots of Business

Around 2004, an agent referred a Russian gentleman to me for a purchase. He was very wealthy, very well-dressed, very polished, very serious – and very intense.

His first purchase went well, as he had a “trading company” that we used for his employment verification and he had ample assets that I was able to verify.

But then he kept coming back for more and more purchases under his name and under the name of various employees – and it all just kept getting shadier and shadier.

The “employees” could never fully explain what they did, and the “trading company” had very little web presence or other indications that it was a large enough firm to accommodate multiple employees or generate that much income.

When I started to suspect that I was just helping a bunch of guys launder money into U.S. real estate, I told the agent and the Russians that I was out.

The agent got mad and started to use another loan officer – something that happened to me often prior to 2008, when I would refuse to go too far down the “stated income, stated asset” rabbit hole.

A few years after the meltdown, I started to read about Russian syndicates pushing all kinds of loan schemes in CA in order to both launder money and/or defraud lenders.

I even knew a loan officer who went to jail because she got so involved in all of the shenanigans of one of the syndicates (they used fake or straw buyers and fraudulent appraisers to pay over-market prices for “new builds” and then got kickbacks from the builders who were also fraudulent).

This all took place around 2005 and 2006 – when nobody seemed to think it would all come home to roost someday.

BUT – it all did come crashing down over five years later – after the foreclosures and long investigations.

The Russians were long gone, but the appraisers, lenders, and builders who got involved in the schemes all faced the music.

Burying Bad Loans in Large Pools

Lending guidelines have changed for the good since 2008, and there is no room for fraud like I discuss above in today’s mortgage world.

BUT – there did seem to be room for loans that did not meet all of today’s lending requirements.

We have had numerous borrowers over the years who we simply could not qualify no matter what we did – but they were able to qualify at other lenders.

This would make us shake our heads and wonder what we could have possibly missed… until we found out what really happened.

The lenders were not actually qualifying these borrowers in most cases; they would instead just turn a blind eye to some of the lending requirements and then “bury” the loans in large pools of loans (as much as $100 million or more) they would sell to Fannie Mae or Freddie Mac.

They assumed that Fannie and Freddie would never audit all of the loans for compliance… just like the people involved with the Russians thought they’d be OK.

But – this year Fannie and Freddie did start to audit those loans, and now they are coming back to these mortgage banks and making them buy back those loans (years after they funded).

What makes this so deadly is the fact that the loans often have very low rates – around 3%.

So, when these lenders have to buy back these loans from Fannie and Freddie, they then have to resell them because they are not allowed to keep them.

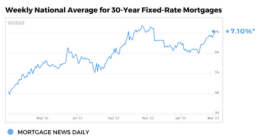

But – when these lenders have to resell 3% mortgages in an environment in which rates are in excess of 6%, they have to take enormous discounts – and can easily lose as much as $100,000 on a single loan.

Needless to say, too many of these buybacks can push a lender over the edge – particularly in a tough year like this.

The purpose of this blog is to share a few reminders:

- Shady actions often come home to roost sooner or later – particularly when things slow down;

- If a lender is making a deal work that nobody else can, it might not always be for the right reason;

- Loan buybacks are deadly – and that is why lenders are so obsessed with perfect compliance (and why they can’t turn a blind eye to seemingly irrelevant or tiny conditions);

and - This is one more thing the mortgage industry is facing in what has already been a pretty tough year.

Jay Voorhees

Founder | JVM Lending

(855) 855-4491 | DRE# 1197176, NMLS# 310167