According to this tweet by MacroAlf, the lower-than-expected inflation report surprised 65 out of 67 economists surveyed by Bloomberg.

It did not, however, surprise Barry Habib or Jeff Snider in the least, as they are the two macro pundits I have been citing over and over for the last year, and they have been predicting this exact drop in inflation and rates now for over a year.

So, both have been right all year, and both are predicting further rate decreases. So, once again, based on their excellent track records, I think we can expect further mortgage rate decreases – NO MATTER WHAT THE FED SAYS OR DOES, as I explain below.

The Fed Does Not Control Interest Rates!

The Fed raised the short-term “Fed Funds Rate” 0.25% in March; 0.50% in May; 0.75% in June; 0.75% in July; 0.75% in September; and 0.75% in November, and it will raise rates another 0.50% today.

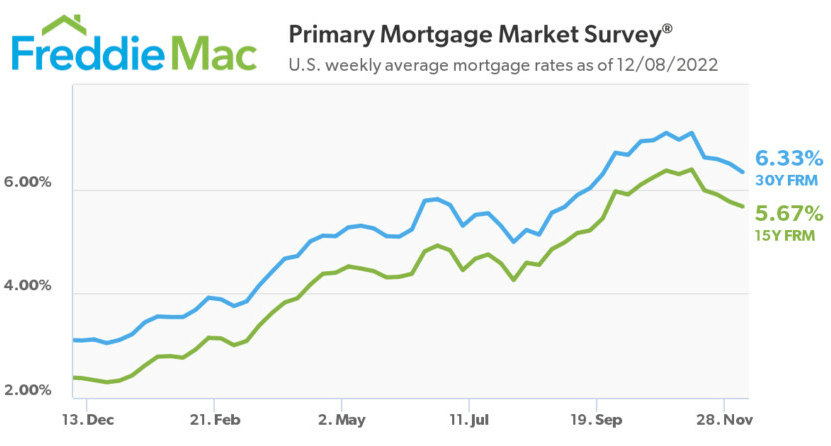

But – if you look at mortgage rates over the last 12 months in the chart at the bottom of this blog – you can clearly see that long-term mortgage rates do NOT always correlate to short-term Fed Funds Rates.

In fact, mortgage rates plummeted after the Fed’s 0.75% increase in June, and they plummeted again after the Fed’s 0.75% increase in rates in November.

“The Fed Is Just a Cult”

The entire point of Jeff Snider’s Eurodollar University podcast today was not only that the Fed does NOT control interest rates like everyone thinks, but also that Fed and the Fed-centric economics profession is utter nonsense. Snider even goes so far as to say that the Fed is a cult, and Paul Volker is the god all the Fed-followers errantly bow down to.

Snider gives myriad examples again of how and when the Fed is almost always wrong and/or late to draw conclusions. Snider further points out how it is the huge Eurodollar Market that drives rates.

The Eurodollar Market consists of all of the offshore banking in U.S. dollars that takes place outside of the U.S. and outside of the control of the Fed. It is so huge compared to our domestic banking system and dollar supply that the Fed has almost no control over it.

The Fed can influence short-term rates and even markets in the short term with its comments… but in the long run the bond markets decide what long-term rates will be – irrespective of Fed policy.

Per Snider, the only accurate indicator of where rates are heading is the bond market. And the bond markets, which focus heavily on inflation and economic growth prospects, are predicting much lower rates.

We know this, per Snider, because the “Yield Curves” are inverted – meaning that long-term rates are LOWER than short-term rates. In “normal times” when bond investors do not expect a recession and/or lower inflation, long-term rates are always higher than short-term rates.

Snider’s disdain for the Fed and everything its members think, say and do is palpable. Per Snider, they desperately cling to their “all powerful” narrative and push everyone else to do the same solely so they can maintain their power.

So – when you’re having your holiday dinner with your family and your know-it-all Uncle Bill tries to tell you that rates are going to go up again because the Fed says so, please point to 2022 as just one example of where he is wrong. And you might share Jeff Snider’s podcast with him too.

I might add that Snider could be wrong… but he hasn’t been yet.

Mortgage Rates over Last 12 Months

Jay Voorhees

Founder | JVM Lending

(855) 855-4491 | DRE# 1197176, NMLS# 310167