“Homebuyers prefer permanent buydowns rather than temporary buydowns.”

That was a headline today in this National Mortgage News article.

So, even though I just blogged about this in November, I am hitting it again because “I hate permanent interest rate buydowns.”

According to the article, 57% of buyers in the third week of January paid points to buy down their rate, while only 3% paid points for temporary buydowns.

That was heartbreaking to read because I think 99% of the 57% will soon realize they wasted their money.

As a quick reminder – “permanent buydowns” simply involve paying points to permanently buy down one’s interest rate. One point (1% of the loan amount) usually buys the rate down by about 1/4%.

“Temporary buydowns” in contrast only buy down the rate for one, two, or three years – depending on how much is paid. A 3-2-1 Temporary Buydown would buy the rate down by 3% in year 1, 2% in year 2, and 1% in year 3.

I like temporary buydowns much better because buyers get the money that was paid for the buydown refunded if they refinance BEFORE they can take full advantage of the temporary (1, 2 or 3 years) rate reduction.

Borrowers with permanent rate buydowns, however, do not get their buydown funds refunded if they refinance – and that is why I dislike permanent buydowns so much right now.

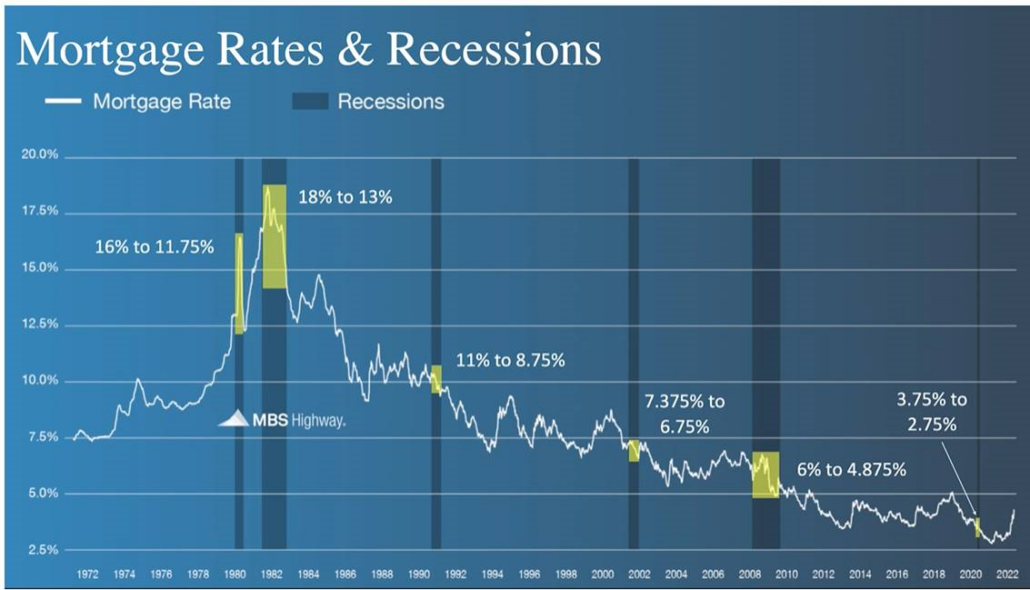

Barry Habib reminded us again today of how likely a recession is in the near future, as a full 93% of America’s top CEOs surveyed believe a recession is imminent.

And every time there is a recession, rates fall (please see the chart I “borrowed” from Barry at the bottom of this blog). And – when rates fall, most borrowers can refinance for free.

So – all of those buyers who paid points in January will have effectively wasted that money – if they can refi into a lower rate in June (which is very likely).

If I was certain rates were going to increase, I might not be as opposed to permanent rate buydowns. But even in rising rate environments, borrowers still end up keeping their loans for shorter periods of time than they originally expected.

I often tell the story of how I had a friend pay a point to buy down his rate in 2009 because I thought rates would never go lower and because his point reduced the rate by a full 1/2% back then.

BUT – six months later, I was able to refinance him again into an even lower rate at no cost. And that made for a very painful phone call when I had to explain that he had wasted $5,000 with his last refinance.

In any case, I simply don’t like permanent buydowns because the money too often ends up wasted.

Jay Voorhees

Founder | JVM Lending

(855) 855-4491 | DRE# 1197176, NMLS# 310167